Reducing Loan Risks Through Financial Assistant Technology

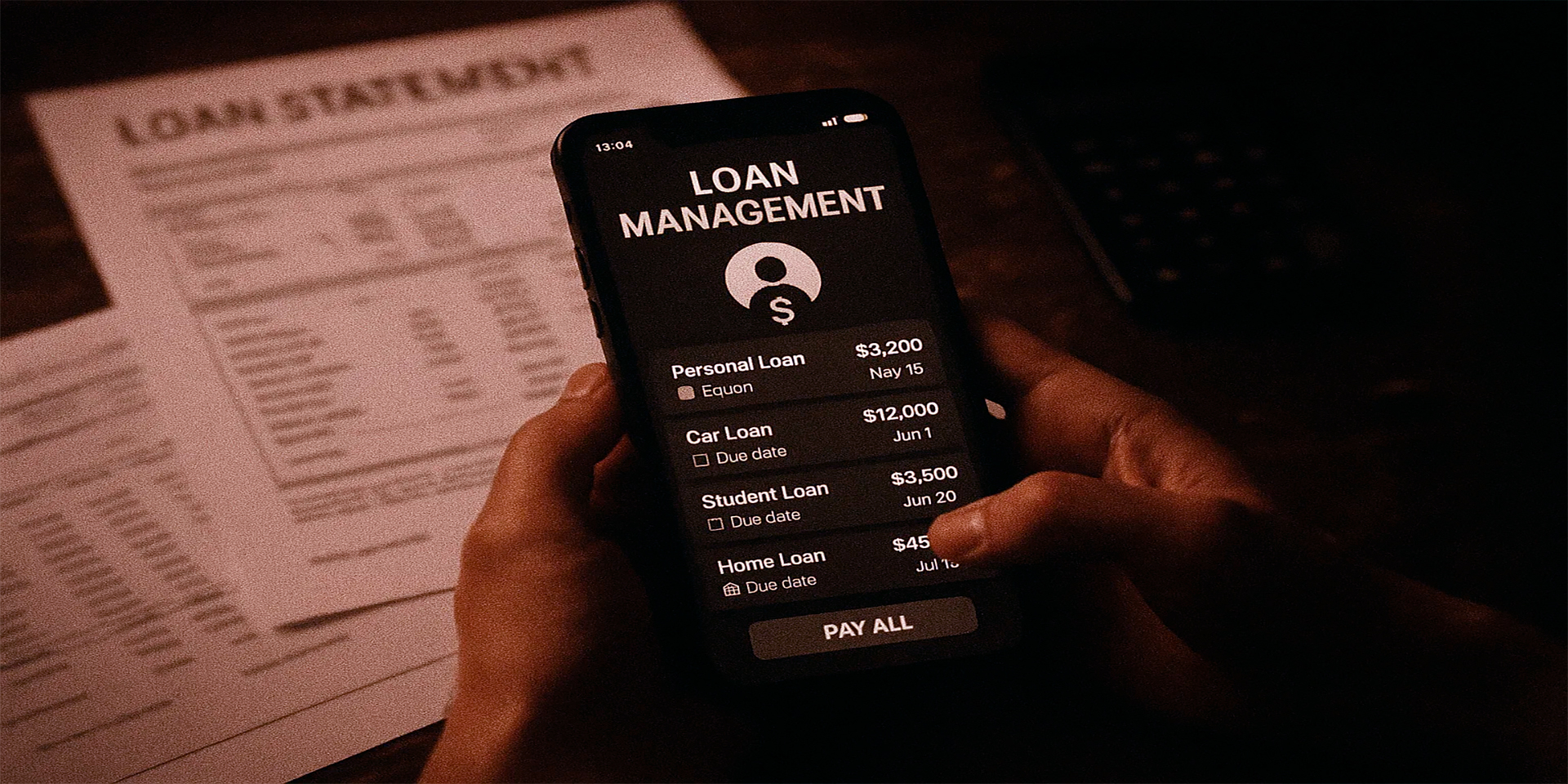

Personal Financial Assistant and Loan Management

Managing several loans at once is not just difficult—it can be overwhelming. Each credit line comes with its own repayment calendar, unique interest rates, and penalties if you slip. Missing a single date can trigger a chain reaction: late fees, higher charges, and long-term damage to your credit profile. That is why many households and companies are adopting digital personal financial assistants. These systems bring every loan into one space, making it easier to plan, prioritize, and pay. Instead of feeling buried in paperwork, you gain clarity and control.

Why Loan Management Needs Structure

Most families and small businesses hold multiple forms of debt. Mortgages, car financing, student obligations, business loans, and credit cards all compete for attention. Without a structured system, you risk missing key dates, paying more interest than necessary, or failing to notice creeping balances. Structure is less about rules and more about transparency. A personal assistant delivers that transparency by aligning every repayment with clear visibility of cost and timing. With structure, you lower risks, avoid accidental defaults, and keep your financial reputation stronger. This approach not only saves money but also reduces anxiety, which is often the hidden cost of disorganized finances.

Everyday Challenges

- Repayments spread across the month without coordination.

- Interest rates and hidden fees that remain unnoticed until too late.

- Manual reminders that collapse during unexpected life events.

- Difficulty predicting total monthly debt burden when incomes fluctuate.

How Personal Financial Assistants Work

These digital platforms link directly to bank accounts, credit cards, and lender data. They track balances, highlight upcoming payments, and even recommend repayment strategies. Many include predictive alerts for loans with rising interest costs. Others provide dashboards that align cash inflows with repayment obligations, giving businesses a buffer against liquidity shortages. Their true power lies in integration: every loan, every deadline, and every fee presented in one view. This approach transforms debt from a scattered burden into a manageable, organized routine. By centralizing information, these assistants help you see not just what you owe, but also how your repayment plan shapes your financial future.

Features You Can Expect

- Unified dashboards summarizing all loans in real time.

- Automatic reminders before due dates.

- Side-by-side comparisons of interest costs.

- Historical repayment trends and behavior insights.

- Predictive modeling to identify high-risk loans before they spiral.

Typical Loans and Their Complexity

| Loan Type | Common Term | Interest Sensitivity | Risk if Missed |

|---|---|---|---|

| Mortgage | 15–30 years | Moderate | Foreclosure, lasting credit damage |

| Car Loan | 3–7 years | Low to moderate | Vehicle repossession, credit drop |

| Credit Card | Revolving | High | Rapid balance growth, penalty rates |

| Small Business Loan | 1–10 years | High | Cash flow strain, breach of contract |

| Student Loan | 10–20 years | Moderate to high | Default, wage garnishment |

Financial Assistants as Risk Reducers

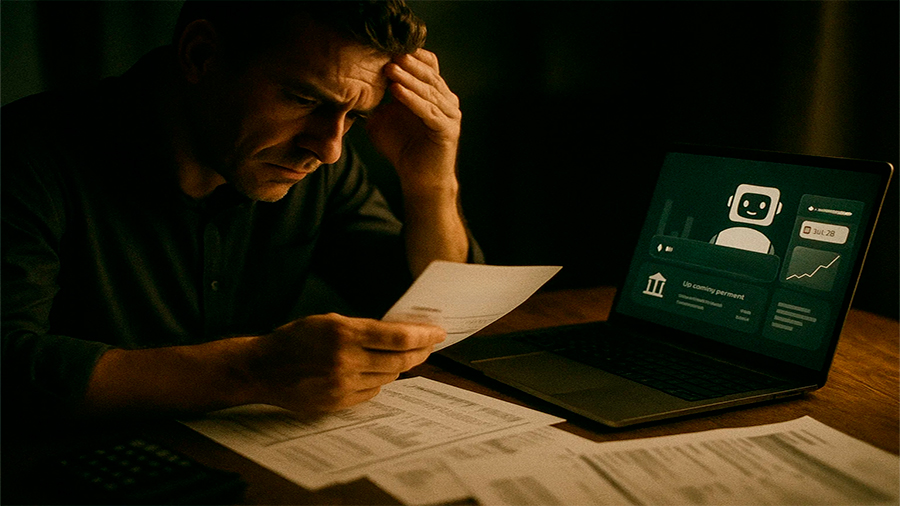

Late payments cause more than temporary stress. They mark you as high-risk to lenders and rating agencies. A negative pattern lowers credit scores for years, making future borrowing more expensive. Assistants minimize these risks with proactive notifications and structured calendars. Even the simplest features—reminders, automated categorization, or forecasting—have significant effects. For households, they make budgeting smoother. For companies, they preserve capital access. The technology bridges the gap between human limitations and financial discipline, ensuring debt never spirals out of control. Over time, this builds resilience, allowing both individuals and businesses to recover faster from shocks such as job loss or sudden market downturns.

Case in Point

A couple managing a mortgage, student loan, and credit cards saved hundreds by eliminating penalties after adopting an app that aligned all due dates in one calendar. With savings redirected, they shortened their mortgage term by two years. Similarly, a startup running on thin margins used alerts to avoid overdraft fees, which had previously cost them thousands annually.

Comparing Manual vs. Digital Management

Manual methods like spreadsheets or paper notes work when debt is minimal. As credit lines increase, these approaches collapse. Interest rate changes, variable repayment structures, and penalties can quickly make manual tracking inaccurate. Digital assistants solve this by updating automatically, syncing directly with accounts, and providing real-time accuracy. This reliability removes the stress of oversight and ensures every decision rests on the latest data. Instead of constantly adjusting notes, you rely on a system that stays current without effort. For small firms, this can be the difference between scaling effectively and drowning in administrative overhead.

| Aspect | Manual Tracking | Digital Assistant |

|---|---|---|

| Accuracy | Dependent on discipline | Automatic, real-time |

| Time Required | High | Low |

| Risk of Missed Payment | Moderate to high | Low |

| Adaptability to Changes | Weak | Strong |

| Stress Levels | High during busy months | Reduced by automation |

Behavioral Benefits of a Financial Assistant

Visibility builds discipline. When every repayment is visible on a dashboard, you feel accountable and motivated. Each reduction in balance provides reinforcement to continue. For managers, assistants bring transparency, allowing teams to track credit health without confusion. This shift moves loan management from reactive—fixing mistakes after they occur—to proactive—anticipating risks before they escalate. Over time, the habits shaped by these tools create long-term resilience, better credit outcomes, and less emotional stress around money. In practice, this means fewer sleepless nights, improved negotiations with lenders, and a more stable financial trajectory.

Example in Business

A retail distributor constantly incurred late fees across several credit facilities. After adopting a digital assistant, repayment dates were linked directly to invoice cycles. Penalties disappeared within a year, freeing enough working capital to expand their inventory base without new borrowing. A freelancer managing multiple small loans also benefited, as the assistant aligned repayments with unpredictable income flows, reducing the risk of falling behind during slower months.

Integration with Broader Financial Planning

Loan management becomes more powerful when integrated with income and investment planning. Assistants now connect repayment schedules with salary inflows, expense categories, and even savings goals. This integration helps individuals choose whether to accelerate debt repayment or invest spare cash elsewhere. For businesses, linking debt oversight with budgeting enables better decisions on growth versus repayment. By unifying different areas of money management, assistants transform scattered financial decisions into coordinated strategies that align with long-term goals. These systems no longer simply track loans—they actively guide strategy, making debt part of a bigger financial picture rather than an isolated concern.

Future Trends

Artificial intelligence will push these systems further. Predictive tools will identify which loans to refinance, which repayment strategies save most, and how upcoming financial shifts may impact obligations. Integration with credit scoring will show users how each payment immediately influences their profile, making the connection between behavior and rating far more visible. Over time, assistants may evolve into negotiation tools, helping borrowers secure better terms directly with lenders by showing detailed repayment histories and cash flow predictions.

Before and After Financial Assistant Adoption

| Category | Before Assistant | After Assistant |

|---|---|---|

| Average Late Fees (per year) | $450 | $0–$50 |

| Missed Payments | 3–5 annually | 0–1 annually |

| Interest Paid | Higher due to missed payments | Reduced through strategic repayment |

| Credit Score Trend | Declining or stagnant | Consistently rising |

| Stress Impact | Frequent anxiety over due dates | Improved stability and peace of mind |

The Conclusion

Managing multiple loans without structure leads to mistakes, higher costs, and damaged reputations. A personal financial assistant aligns all obligations into one clear framework, turning confusion into order. Real examples show how households and businesses eliminate penalties, save money, and improve borrowing conditions. With manual oversight increasingly unreliable, automation has become essential. By linking repayments with income, goals, and risk monitoring, these assistants evolve from reminders into active partners in financial planning. They help transform debt from a liability into a manageable, predictable part of daily life. As technology advances, these tools will not only support repayment but also shape smarter strategies for financial independence.