Building Resilient Supply Chains With Strategic Loans

Using Loans to Diversify Supplies and Avoid Dependence on China

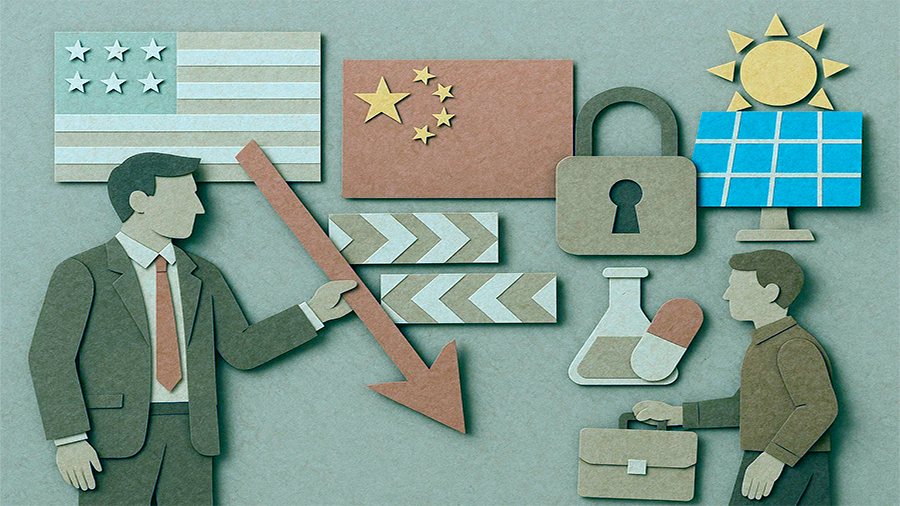

For decades, China has been the world’s central hub for manufacturing, logistics, and raw materials. From smartphones to car parts, countless businesses rely on Chinese factories and ports to keep their operations alive. But recent years have shown how fragile that dependence can be. Trade wars, tariffs, lockdowns, and shipping delays have left firms exposed to risks outside their control. That has pushed many companies to look elsewhere, seeking new suppliers in regions such as Southeast Asia, Latin America, or Eastern Europe. Loans are now playing a crucial role in this transition, providing the capital needed to reduce dependence and build diversified, resilient supply chains. In today’s climate, borrowing is not just about growth—it’s about protection from disruption.

Why Reducing Dependence on China Matters

Supply chains anchored too heavily in China face mounting risks. Tariff hikes, stricter regulations, and geopolitical conflicts can suddenly make shipments more expensive or even impossible. The COVID-19 pandemic highlighted another vulnerability: shutdowns at Chinese ports created global shortages that left companies unable to meet demand. Even firms with strong management teams and healthy finances were caught off guard. Diversification helps prevent these shocks from crippling operations. Loans give firms the resources to fund that process—whether by onboarding new suppliers, investing in warehouses closer to consumers, or financing raw material sourcing in alternative markets. The goal is not to abandon China entirely but to avoid being overly dependent on one market that can change the rules overnight.

How Loans Enable Supply Diversification

Diversifying supply chains is expensive, and companies rarely have the cash on hand to fund it without financing. Loans bridge the gap, providing liquidity to cover new partnerships, trial shipments, and infrastructure investments. A retailer might use working capital loans to test garment producers in Vietnam. A technology company could turn to trade finance to secure circuit boards from Taiwan or South Korea. Infrastructure loans may help an automotive supplier build a warehouse in Eastern Europe to cut shipping times. Loans give firms flexibility to adapt quickly and protect themselves from overreliance on China, especially when disruptions can escalate without warning.

Typical Loan Applications in Supply Diversification

| Loan Type | Practical Use |

|---|---|

| Working capital loans | Fund trial orders with new overseas suppliers |

| Trade finance | Secure import/export contracts in non-China markets |

| Infrastructure loans | Build regional storage or distribution hubs |

| Equipment financing | Modify production lines for different inputs |

Geopolitical Risks Driving Supply Diversification

Geopolitics remains the strongest driver behind the diversification trend. Trade disputes between the United States and China have shown how quickly tariffs can shift, raising costs for businesses overnight. Export restrictions, such as those on rare earth minerals or advanced technology, threaten industries like renewable energy and semiconductors. Sanctions or political tensions can lead to sudden border checks or closures, derailing contracts. Loans give firms the ability to adjust sourcing in response. A solar panel company, for example, may borrow to establish suppliers in India to reduce exposure to Chinese polysilicon exports. Similarly, a pharmaceutical firm might use financing to secure critical ingredients from European labs, limiting the damage from sudden policy shifts.

Examples of Geopolitical Triggers

| Trigger | Impact |

|---|---|

| Trade tariffs | Sharp rise in end product prices |

| Export bans | Shortages in semiconductors or rare earths |

| Border closures | Cancelled delivery contracts and penalties |

| Regulatory sanctions | Restricted market access for key goods |

Costs of Building Multi-Supplier Networks

Creating a multi-country supply chain requires major upfront investment. Companies need to conduct supplier audits, build compliance frameworks, and design new logistics routes. These processes cost money long before new revenues appear. Loans spread these costs over time, keeping businesses liquid while they diversify. For example, a European clothing brand may need to pay consultants to evaluate factories in Bangladesh and Turkey before signing contracts. An automotive manufacturer might borrow to finance dual sourcing of batteries from South Korea and Poland, reducing reliance on Chinese factories. Without financing, many companies would remain trapped in old structures, unable to absorb the initial diversification costs.

Industries Most Motivated to Diversify

Some industries face greater urgency than others. Electronics companies, which depend heavily on Chinese manufacturing for smartphones, semiconductors, and components, are at the top of the list. Fashion and textile brands are also shifting, turning to Vietnam, Cambodia, and India to reduce exposure to Chinese production. Automotive firms are diversifying battery and chip supply to multiple regions, avoiding disruptions like the global semiconductor shortage. Pharmaceuticals and medical equipment producers are also acting quickly, after the pandemic exposed reliance on Chinese inputs for essential products. Loans allow these industries to fund multiple supplier relationships at once, ensuring that if one country faces disruption, others can pick up the slack.

Industry-Level Diversification Needs

| Industry | Reason for Diversification | Example |

|---|---|---|

| Electronics | Reduce chip and component dependence | Tech firms sourcing processors from Taiwan and Korea |

| Textiles | Lower costs and spread production risk | Brands moving orders to Vietnam and India |

| Automotive | Secure battery and chip supply | Car makers financing battery plants in Europe |

| Pharmaceuticals | Guarantee access to ingredients | Firms sourcing chemicals from European suppliers |

Real-World Examples of Diversification Through Loans

Several companies have already used loans to diversify successfully. A global apparel retailer borrowed to establish production lines in Bangladesh, reducing its dependence on Chinese textiles by 30% within two years. A U.S.-based electronics manufacturer secured trade finance to source critical components from South Korea and Vietnam, cutting shipping times and lowering tariff exposure. An automotive supplier took infrastructure loans to build a logistics hub in Eastern Europe, ensuring faster delivery to its customers in Germany while reducing exposure to Chinese shipping delays. These examples highlight how loans serve as a practical tool for building independence while sustaining competitiveness.

How Lenders Can Support Diversification Strategies

Lenders are not just observers in this process—they are essential players. Financial institutions that create products tailored to supply chain diversification can help firms transition faster and more securely. Trade finance agreements for non-China imports, risk-sharing credit facilities, and flexible repayment schedules tied to logistics cycles make diversification more realistic. Lenders who understand the strategic risks of overreliance will become trusted partners, offering credit not only for growth but for stability. By doing so, they gain access to new lending opportunities and strengthen long-term relationships with globally active businesses. Financing resilience is no longer a niche—it is a mainstream need.

The Conclusion

Supply chain diversification has shifted from a long-term strategy to an immediate necessity. Overdependence on China has left businesses exposed to geopolitical shocks, cost volatility, and logistics disruptions. Loans provide the capital to break that dependence, covering the upfront costs of new suppliers, regional hubs, and compliance processes. From electronics to fashion, automotive to pharmaceuticals, industries are using financing to spread risk and strengthen resilience. While the process demands investment and careful planning, the long-term payoff is independence. In today’s volatile environment, loans are more than a tool for expansion—they are the engine driving freedom of choice and stability for businesses worldwide.